Company Update / Coal / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

- Komatsu sales volume remained soft (-2% mom, in-line with our forecast), which was offset by robust Pama volumes (+8% mom)

- Coal mining volumes declined 7% mom, while Martabe gold sales volume rebounded as mining operations continued in Jan-Feb24.

- We upgraded our earnings estimates by +12/+25% in FY24/25F and maintain our Hold rating at upgraded SOTP -based TP of Rp27,500.

Komatsu volume remained soft in Mar but 1Q24 remains in-line

Komatsu sales volume remained soft at 301 units (-2% mom), driven by demand decline from agricultural industry (-17% mom). Overall, Komatsu deliveries declined to 1,126 units in 1Q24 (-37% yoy), in-line with our estimate (28% FY24F). The decline in volume is primarily attributed to normalizing commodity prices. Management reiterated that big machine deliveries remains on-track with their FY24F guidance.

Pama continued to improve

Production volume continued to improve to 12Mt in Mar24 (+10% mom) on the back of additional demand from existing clients, in addition to timely delivery of heavy equipment. As a result, OB volume rose to 102mbcm (+8% mom) despite slightly lower stripping ratio of 8.8x (-2% mom). Overall, coal production/OB volume reached 32Mt/286mbcm in 1Q24 (+18/+16% yoy), in-line with our FY24 estimates (at 23/24% respectively).

Mining: coal volume remained strong, gold sales volume catching up

TTA thermal/coking sales volume slightly declined to 1.0/0.3Mt in Mar24 (-6/-12% mom) on delay in delivery. Overall, thermal/coking coal sales volume reached 3.2/0.8Mt in 1Q24 (+40/+10% yoy) driven by easing logistical issue from higher rainfall. Separately, Martabe gold mine sales volume successfully rebounded to 49kt in Mar24, after two consecutive months of zero sales as RKAB was approved in Mar-24, indicating monthly run rate of 16-17kt, which came below our FY24F forecast (1Q24: 19%)

Maintain Hold at unchanged SOTP -based TP of Rp27,500/share

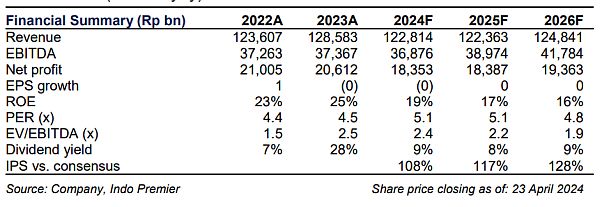

We maintain our Hold rating but upgraded our SOTP -based TP to Rp27,500 (from Rp24,000 previously) to reflect +12/+25% earnings upgrade in FY24/25F mainly attributed to higher coal sales volume of 15.5/16.5Mt (+30/26%) and nickel revenue inclusion. However, we revised down our gold sales volume to 235/270k oz in FY24/25F (-10%). Additionally, we upgraded our mining contracting target P/E to 5x (from 4x previously) to reflect earnings stability premium compared to coal mining business. Key downside risks are lower than expected coal price and interest rate hike, considering that total debt stood at c.Rp17.9tr by end of FY23 (+793% yoy).

Sumber : IPS